What is cryptocurrency? Just a couple of years ago, governments and major financial institutions worldwide repeatedly screamed about cryptocurrency’s evils. They wanted everyone to believe it was all a scam created to take your money and that the entire cryptocurrency market was doomed to fail. Here we are two years later – governments are creating their own cryptocurrency assets, and countries accept Bitcoin as legal tender. International banks are even advising a portion of your portfolio should hold crypto. What happened? Let’s explore how cryptocurrency evolved to its current state, where it’s going, and why it is here to stay.

Cryptocurrency is digital money that can be used to purchase goods and services, just like “real world” currencies like the U.S. dollar. Investing $50 a month in Bitcoin can result in over $336,000 after 5 years.

Cryptocurrency history: from world pariah to modern-day acceptance

In 2009, a mysterious figure known as Satoshi Nakamoto launched Bitcoin, considered the first cryptocurrency. There were earlier attempts at making cryptocurrencies, but for various reasons, none succeeded. To this day, no one knows who Satoshi Nakamoto is, but we do know he created Bitcoin as a way to make a decentralized peer-to-peer electronic cash system that everyone could use.

In 2014, banks were searching for ways to minimize the growing influence of cryptocurrencies. After many discussions, they decided the best way to deal with cryptocurrency was to delegitimize it by sowing doubt into the minds of the public. They began to spread stories of cryptocurrency being used for criminal activities.

In 2015 and 2016, exchanges carrying Bitcoin suffered major hacks resulting in millions of dollars in Bitcoin being lost. Despite this setback, the value of Bitcoin and many other cryptocurrencies continued to increase, and large players in the financial sector began to show interest.

In 2017 China announced a ban on all cryptocurrency exchanges. This resulted in a short period of panic. 2017 to 2018 saw Bitcoin reach a high of almost $20,000 before dropping significantly to about $3,200. During this time, Ethereum, the second most popular cryptocurrency, went from $10.00 to over $1,000 before falling back down to around $110.

Cryptocurrency remained in sideways price action for the next couple of years until May 2020. This is when the Bitcoin halving took place, resulting in the amount of new Bitcoins entering circulation being cut in half. This halving occurs approximately every four years and, in Bitcoin’s short history, has always significantly increased the price of Bitcoin and many other cryptocurrencies.

In 2021, Bitcoin’s price shot up to approximately $68,000. Ethereum went from $245.00 all the way up to $4,425. A number of other cryptocurrencies also went up incredible percentages during this time. However, just as earlier cycles experienced, the entire cryptocurrency market eventually fell back down to where we are now. Bitcoin currently hovers around $30,000, and Ethereum is going for about $1,800. The next Bitcoin halving takes place in March 2024, and many cryptocurrency creators are continuing to improve their products.

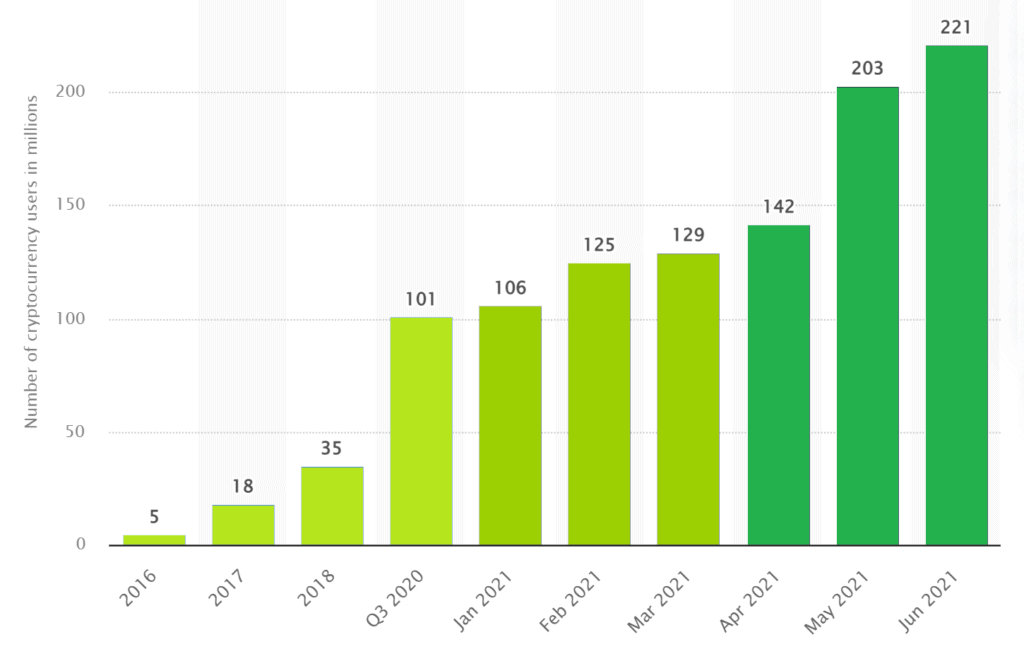

As cryptocurrency continues to increase in value over time, its popularity continues to increase yearly. The number of cryptocurrency users worldwide increased from 5 million in 2016 to over 221 million in 2021. This is according to data pulled from statista.com.

Semi-hidden ways to make passive income in cryptocurrencies

Now that we have quickly explored the question: what is cryptocurrency, as well as the history, and growth, let’s see some of the many ways we can make money from it. It is often assumed the way to make money from cryptocurrency is to simply “buy low, sell high”. This means buying when cryptocurrencies are being sold at a low price and selling those assets when they are well above the purchased price. Although this is the main method most investors use, there are many other options:

- Mining – Cryptocurrency Mining is using computer systems equipped with specialized components to generate new cryptocurrency coins and verify new transactions. Some of the top cryptocurrencies to mine right now are Bitcoin, Monero, and Ravencoin.

- Lending – Cryptocurrency Lending involves investors lending their cryptocurrency to borrowers for a fee or interest payments. Borrowers are incentivized to take crypto-backed loans over traditional loans using “fiat” (real world) money through offers of low-interest rates, no credit checks, and fast funding. Lenders can receive 18% or more depending on the cryptocurrency they are lending.

- Staking – Cryptocurrency Staking usually requires locking up your digital tokens for a period of time in order to help the performance and security of a blockchain network. In exchange for staking your tokens, you earn interest in the form of more tokens. The amount of interest can be incredibly generous, with some coins offering 75% or more annually.

The future of cryptocurrency

What does the future look like for cryptocurrency? Well, the first thing to mention is that cryptocurrencies are not going away. From the humble beginnings in 2009, there are now more than 18,000 cryptocurrencies in existence. Many of these cryptocurrencies were created to solve current problems the world faces. Some of the problems cryptocurrency aims to solve include:

- a. Supply chain/logistics issues by accurately tracking the movement of products with the help of cryptocurrencies like VeChain.

- b. Inflation. World governments continue to print unlimited amounts of money, resulting in high levels of inflation. Bitcoin has a hard limit of twenty-one million coins and will never be more than that.

- c. Inefficient transfer of payments. The current payment systems charge high fees and take a lot of time to process, while cryptocurrencies like Cardano will offer payment options that are fast and cheap.

Cryptocurrencies are heavily involved in the metaverse, an immense virtual world or a network of virtual worlds, where people can socialize, work, play, and shop. People can already buy virtual land, art, homes, cars, and many other goods and services using digital currencies. Once purchased, those items belong exclusively to the owner to do as they please. Often, just like in the real world, the value of the items will increase over time.

Virtual goods and services can be very expensive. The most expensive NFT ( NFTs are digital assets representing real-world items like art, music, and videos), called “The Merge”, sold for $91,800,000. Digital plots of land in virtual worlds consistently sell for around $5,000.

As the metaverse continues to grow, the amount of money being invested in it will also continue to increase. Some estimates show the metaverse market can grow from its current amount of 39 billion dollars to approximately 947 billion dollars by 2030. During this growth, cryptocurrencies will continue to serve as a link between the physical and virtual worlds. This will result in many metaverse cryptocurrency coins and tokens increasing in value by billions of dollars.

How investing $50 a month can change your life

At the beginning of this article, I wrote that saving $50 a month can result in making over $336,000 after five years. This amount was reached by first determining the average yearly growth for Bitcoin from 2011 through 2021, with the result being 230%. Calculating $50 a month for 12 months equates to $600 a year, which is the amount we will start with in year 1.

- Year 1: Initial amount = $600. 230% interest = $1,380. Year one total = $1,980

- Year 2: Initial amount ($600 + $1,980) = $2,580. 230% interest = $5,934. Year two total = $8,514

- Year 3: Initial amount ($600 + $8,514) = $9,114. 230% interest = $20,962.20. Year three total = $30,076.20

- Year 4: Initial amount ($600 + $30,076.20) = $30,676.20. 230% interest = $70,555.26. Year four total = $101,231.46

- Year 5: Initial amount ($600 + $101,231.46) = $101,831.46. 230% interest = $234,212.358. Year five total = $336,043.818

The above example used Bitcoin, but many other cryptocurrencies can be used with similar results. Since its inception, Ethereum’s average yearly return is 170%, Cardano’s average yearly return is 165%, and Binance’s average yearly return is 203%. These three cryptocurrencies are some of the top ten cryptocurrencies in the world. Each of them is worth more than 10 billion dollars, making them equivalent to large-cap stocks. Large-cap cryptocurrencies are what conservative investors look for when wanting to purchase relatively “safe” investments. They tend to be less volatile due to the amount of money required to make the cryptocurrency significantly increase or decrease in value.

In understanding the potential of Bitcoin, Ethereum, Cardano, and Binance, it’s essential to grasp the concept of, “what is cryptocurrency”. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized technology called blockchain. They offer various use cases, including as a medium of exchange, a store of value, and even as programmable smart contracts.

The amount of funding these three cryptocurrencies have invested in them should easily allow them to survive the current bear market in which the cryptocurrency market finds itself. This bear market is not just affecting the cryptocurrency market. The stock market has been down significantly since the beginning of the year, with the Nasdaq down nearly 25%. Since the stock market was created, there have always been bull market cycles followed by bear market cycles. As scary as it is to see your investments go down in value, patient investors understand history usually repeats or, at the very least, rhymes. The financial markets will turn around. Once this bear market cycle reverses and a bull market is back on, Bitcoin, Ethereum, Cardano, and Binance are likely to grow significantly in their values.

The cryptocurrency market is still very young. The saying, “You are early,” is a very accurate assessment. It has grown quickly since its inception in 2009 but should still see many years of fast growth.

Scammers are attempting new schemes every day to take your crypto. Avoid losing your money to scammers by reading about Cryptocurrency Safety: Best Expert Tips for Beginners.

*This information is not financial advice and is for informational purposes only.

Recent Posts

Top Indicators to Determine the Start of the Crypto Bull Market

In the world of cryptocurrencies, figuring out when the bear market is over isn't straightforward. It's like piecing together a puzzle using different signs and factors. No single thing can outright...

Binance Vs. Coinbase: Comparing Fees, Security, and Ease of Use

Binance and Coinbase are two of the largest and most popular cryptocurrency exchanges in the world. They both offer a wide range of features and services, but they also have some key differences. In...